Aim:

People can use credit cards for online transactions as it provides an efficient and easy-to-use facility. With the increase in usage of credit cards, the capacity of credit card misuse has also enhanced. Credit card frauds cause significant financial losses for both credit card holders and financial companies. Fraudulent activities often go unnoticed due to the complexity of transaction behaviors and the adaptability of fraudsters. The main aim of this study is to detect fraudulent transactions using credit cards with the help of ML algorithms and deep learning algorithms. By implementing advanced techniques such as CatBoost and CNN, we aim to improve fraud detection accuracy and minimize false positives. The research also focuses on dataset balancing, feature extraction, and performance evaluation to ensure the model’s robustness. By integrating these methods, we seek to enhance security and provide an efficient solution for real-world credit card fraud detection.

Abstract:

Credit card fraud is a growing challenge for financial institutions and consumers. The main focus of this research is to apply recent advancements in deep learning and machine learning algorithms for detecting fraudulent credit card transactions. A comparative analysis of both machine learning and deep learning techniques was performed to determine their effectiveness in fraud detection. The study utilizes a credit card fraud dataset to evaluate various models, aiming to improve detection accuracy while minimizing false positives and false negatives. A machine learning algorithm, CatBoost, was first applied to the dataset to enhance fraud detection performance. CatBoost efficiently handles categorical data and missing values, making it well-suited for structured financial transaction datasets. It provides faster training times and improved interpretability, helping to detect fraudulent activities accurately. Later, a convolutional neural network (CNN) was implemented to further improve fraud detection accuracy by capturing intricate patterns in transaction sequences. The CNN model employs multiple convolutional layers, batch normalization, dropout layers, and fully connected layers to extract key features from transaction data. A comprehensive empirical analysis was conducted by optimizing the number of hidden layers, epochs, and hyperparameters to achieve the best possible results. The evaluation metrics, including accuracy, precision, recall, and F1-score, show significant improvements in fraud detection compared to traditional methods. The integration of CatBoost and CNN outperforms existing machine learning and deep learning algorithms, making it a robust approach for credit card fraud detection. Additionally, data balancing techniques were applied to address class imbalance issues, ensuring that fraudulent transactions were adequately represented during model training. The proposed hybrid model can be effectively implemented in real-world financial systems, offering enhanced security and reducing financial losses. The study highlights the potential of combining machine learning and deep learning approaches to develop a more efficient and accurate fraud detection system.

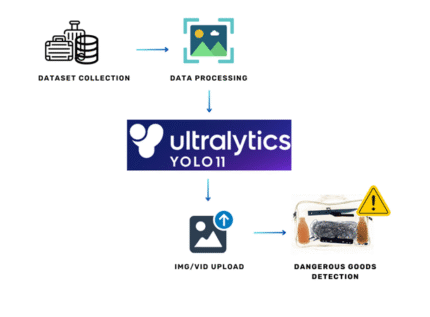

Proposed System:

Deep learning (DL) and machine learning (ML) algorithms are applied in various domains, including fraud detection. In this model, we explore DL and ML algorithms to identify credit card fraud in the banking industry. It uses a combination of deep learning (CNN) and machine learning (CatBoost) algorithms for detecting CCF. CatBoost is a powerful gradient boosting algorithm specifically designed to handle categorical data efficiently. It provides faster training times and improved accuracy compared to traditional tree-based models. The CNN model and its layers are used to analyze transactions and determine whether they are fraudulent or normal. CNN excels at capturing intricate patterns in transaction sequences and anomaly detection. By combining both CatBoost and CNN, the proposed model leverages the strengths of both machine learning and deep learning methodologies. The model is designed to adapt to real-world fraudulent behaviours, making it robust against evolving fraud strategies. Extensive experiments are conducted to evaluate the model’s performance using various performance metrics, including accuracy, precision, recall, and F1-score. The integration of both approaches enhances fraud detection accuracy and reduces false positive rates.

Advantage:

- The hybrid approach leverages CNN’s ability to capture complex transaction patterns and CatBoost’s efficiency with structured categorical data, resulting in higher overall detection accuracy.

- CatBoost’s optimized gradient boosting algorithm reduces training time compared to traditional ensemble methods, while CNN’s parallel computation accelerates pattern learning.

- The hybrid model can be scaled for large transaction datasets and integrated into real-time fraud detection systems for proactive prevention.

- Combining both models helps minimize misclassifications of legitimate transactions as fraudulent, improving customer trust and operational efficiency.

Reviews

There are no reviews yet.